The Impact of Ethereum’s Shapella Upgrade

Introduction

Ethereum will complete the final stage of its transition to proof of stake in a month. After the upcoming “Shapella” upgrade (a portmanteau of “Shanghai” and “Capella”), over 16 million ETH of staked Ether can be withdrawn from the Beacon Chain. This headline figure alone has created confusion and some angst among users, investors, and traders about the possible impacts Shapella has on demand/supply flows for ETH and related tokens.

In this report, we clarify the details of the Shapella upgrade, what to look out for going into the upgrade, and provide our best estimate of how the upgrade may impact ETH, liquid staking derivatives, and other applications.

Quick Takes

- The Shapella upgrade will allow staked ETH on the Beacon Chain to be partially or fully withdrawn. It is expected to occur from late March to early April.

- There are over 1 million accrued ETH rewards on the Beacon Chain. These rewards will be automatically withdrawn, taking around five to seven days for all accrued rewards to become liquid. We estimate around half of these rewards will be re-staked back on the Beacon Chain primarily due to competitive dynamics among staking pool providers.

- There are over 16 million staked ETH principal on the Beacon Chain. We expect around ~2.8 million ETH to be withdrawn but note that this is a conservative estimate and that the range of outcomes is high. We expect ~50% of the withdrawn ETH to rotate back onto the Beacon Chain via liquid staking providers. Key beneficiaries include Lido Finance, Frax Finance, and Coinbase.

- Long-term, because staking ETH will be de-risked, Ethereum staking participation should rise above 40% and act as the de facto benchmark rate across the Ethereum ecosystem.

- Shapella will also have follow-on impacts on DeFi applications including: liquid staking providers, decentralized exchanges, borrow/lending protocols, meta-governance projects, and re-staking infrastructure. Shapella could also have an impact on the supply elasticity of Ether, affecting its volatility as a trading instrument.

The Basics of Shanghai/Capella

The Beacon Chain is the backbone of Ethereum’s proof-of-stake consensus, allowing users to stake their Ether to participate in block validation and earn rewards. The chain began accepting deposits in November 2020 and officially launched on December 1, 2020. Users needed to stake a minimum of 32 ETH to earn issuance rewards for performing consensus duties. Prior to the Merge, consensus duties simply consisted of reaching consensus on active validators and their balances. After the Merge (Bellatrix upgrade), validators became responsible for activities that secure the network, such as block proposal, block attestation, and sync committee participation.

But staked ETH and rewards have been locked up on the Beacon Chain since its inception. So over 16M of staked ETH and 1M of accrued rewards have been stuck on the Beacon Chain for over two years.

Next month, Ethereum is slated to complete an upgrade called Shanghai / Capella. [Upgrades to the consensus layer are named after stairs (Altair, Bellatrix, Capella). Upgrades to the execution layer are named after cities.]

The most salient feature in the upcoming Shanghai/Capella upgrade is the ability for validators to opt to withdraw either their accrued rewards or the entirety of the validators’ balance. Consequently, Ether would move from the Beacon Chain to the Execution Layer, where it is freely liquid and can be used for transactions.

Note that rewards from priority fees and MEV payouts are accrued directly to the Execution Layer (i.e. the chain that Ethereum users transact on today). These rewards are immediately liquid. So the only rewards that are locked up until Shapella are issuance rewards on the Consensus Layer.

All indications suggest that the Shapella upgrade will happen around late March to early April. Testing so far is positive. Developers successfully launched Shapella on the Sepolia testnet on February 28 with only minor issues. They have also completed testing on the Zhejiang public test network and a shadow fork on mainnet.

Sepolia Testnet Successfully Upgraded to Shapella

The next milestone is launching the Shapella upgrade on Goerli around the middle of March before the upgrade hits mainnet.

Withdrawals, Explained

After the Shapella upgrade there will be two types of withdrawals:

1. Full withdrawals. This allows validators to completely exit the Beacon Chain, taking with them their full ETH balance, including their original 32 ETH balance and any accrued rewards or penalties.

Ethereum imposes a churn limit of how many validators can withdraw each epoch (1 epoch consists of 32 blocks and occurs every 6.4 minutes). This limit increases with more validators on the Beacon Chain. Currently, the churn limit is seven. But this will likely settle at 8 validators per epoch by the time of the upgrade. So when the upgrade occurs, 1,800 validators can fully exit every day, which is over 57,600 of ETH/day.

2. Partial withdrawals: Also known as skimming, partial withdrawals allow validators to sweep their balance in excess of the 32 ETH principal. It allows validators to remain active on the Beacon Chain while withdrawing the accrued income that they have earned. Because accrued rewards are idled capital (i.e., rewards do not auto-compound), skimming improves capital efficiency. Without partial withdrawals, validators would have to completely exit the Beacon Chain to collect their rewards, then re-enter once again. Thus, separating partial withdrawals from full withdrawals improves network stability and prevents queue clogging.

Partial withdrawals will happen automatically after the upgrade and average one sweep per week. 16 partial withdrawals will automatically occur every slot, starting from index 0 of the Beacon Chain, which is ~147k validators every day.

Should I Stake or Should I Go?

A potentially large supply shock looms over the upgrade. Over 1 million ETH will be automatically liquid from sweeping of partial withdrawals in the week following the upgrade. That’s ~0.8% of total ETH supply and ~$1.6 billion at today’s price. In addition, theoretically, 16.8 million ETH will be eligible to be withdrawn as well.

The headline figures have caused some FUD. There is a narrative brewing that the market will potentially see large sell flows from enabling withdrawals for ETH that have been illiquid for over two years.

But these concerns may be overblown. Below, we walk through the dynamics of both partial and full withdrawals to better illustrate how withdrawals will work after Shapella and suggest that the supply shock may not be as extreme as headline figures imply.

Please note that our estimates are rough figures and subject to a wide range of uncertainty. Our analysis involves numerous assumptions. Point figure estimates are almost certainly going to be wrong. Nonetheless, we hope that this report provides context behind our thinking and encourages further discussion and analysis.

Partial Withdrawals — Re-Staking Dynamics Lessen Supply Shock

In total, there are over one million of accumulated ETH rewards that will automatically become liquid. Because there’s a partial withdrawal queue of 16 validators per block, and a portion of validators have to first change their withdrawal credentials before receiving these accrued rewards, it would take five to seven days for all partial withdrawals to become liquid on the Execution Layer.

But even assuming most validators are conservative and want to hold liquid ETH on the Execution Layer, there are structural dynamics that compel them to re-stake these rewards back onto the Beacon Chain.

53% of accumulated rewards are from staking pools that offer liquid staking tokens (“LSTs”). The major LSTs are provided by relatively decentralized staking providers, such as Lido and Rocket Pool, or centralized custodians, such as Coinbase and Binance. The fair market price of LSTs vary, from a premium of +1.3% for Rocket Pool’s rETH, to a discount of -3.0% for Ankr’s ankrETH. Most LSTs are priced at a discount of -0.1% to -2.0%, with a greater discount typically given to centralized custodians.

Landscape of ETH Liquid Staking Tokens

We believe the existence of LSTs mitigates the potential supply/sell flow from withdrawals because users who stake through these providers already have the option to convert their staked ETH at a nominal discount.

Furthermore, competitive dynamics incentivize re-staking. Lido, who has the leading market share amongst all staking pools, recently affirmed its policy of “APR maximization” by attempting to re-stake as much ETH as possible. With its stETH token trading at only a -0.1% discount, we estimate there will be minimal demand for stETH redemptions. So Lido will likely re-stake virtually all its accumulated rewards of 224k ETH (~$370M), representing over 20% of total accrued rewards. Other staking providers will be compelled to stake as much ETH as possible too, lest they offer uncompetitive APRs vs. Lido and consequently lose market share.

We share our base case assumptions for the percentage of partial rewards that will get re-staked in the tables below. For staking pools with LSTs, we assume that those with a higher LST discount will see more significant redemption pressure to bring the token back to par.

Our assumptions are admittedly less rigorous for centralized operators with no LSTs and vary based on our understanding of their situation. Kraken, for instance, is unlikely to re-stake given recent SEC charges and its agreement to shut down staking services to US customers. Celsius too would probably prefer liquid ETH.

Nonetheless, our conversations with institutional node operators like RockX suggest that most are expecting to re-stake the bulk of their rewards to maximize yield. Therefore, we expect that institutional-focused node operators, like RockX and Figment, re-stake most of their rewards. For node operators that have more retail users, such as Stakefish and most centralized exchanges, we assume only 20% of partial rewards are re-staked, with the rest used to meet redemption requests.

Validator Distribution by Entity

Assumptions for Partial Withdrawals

Hence, our baseline assumption is that ~52% of total supply from partial withdrawals will be re-staked back to the Beacon Chain, dramatically shrinking the potential supply shock and sell flow.

For more in-depth modeling on partial withdrawals, we recommend this post from Data Always. The author concludes that “the decision to make partial withdrawals automatic likely decreased the initial surge of selling by clogging the queue with validators who do not intend to sell.”

Full Withdrawals — ETH Rotation to LSTs as Base Case Assumption

We forecast full withdrawals from the top 20 distribution of validator entities, consisting ~75% of total validators, and make a generalized assumption for the other 25%:

- Pool operators with LSTs will not fully withdraw any of their validators. Recall from above that over half of validators offer LSTs — and we think all will be able to pull their LST to par with ETH from partial withdrawals alone. In fact, most will likely deploy net new validators due to re-staking their ETH rewards.

- Kraken will withdraw the majority of its staked ETH as it is not allowed to offer staking services to US customers anymore. Although it can offer staking in other capacities, its US-centric customer base and regulatory uncertainty will likely cause outflows from Kraken’s staking product. Similarly, we expect Celsius will fully withdraw all their validators to maximize short-term liquidity.

- For other CEX’s and node operators, we vary assumptions between 10–25% based on our understanding of their target customers (institutional vs. retail) and operating model (pooled vs. solo, custodial vs. non-custodial). We assume that institutional clients will have lower withdrawal needs compared to retail, based on our conversations with various staking participants. Those that operate a pooled/custodial model would also see lower pressure for full withdrawals, as they can net outflows with inflows.

In sum, we estimate ~2.8M ETH being fully withdrawn from active validators post-Shapella.

However, like with partial withdrawals, we expect re-staking. Specifically, we expect many stakers who withdraw to rotate their ETH back to liquid staking providers. This is because providers with LSTs offer several advantages to solo staking, including:

- Potential for immediate liquidity through on-chain pools

- Usage of LST as collateral across DeFi, allowing users to borrow stablecoins, leverage stake ETH, and more

- Convenient accessibility to re-staking primitives such as Eigenlayer

Assumptions for Full Withdrawals

The impact of users re-staking ETH likely reduces total supply shock from full withdrawals by ~50%.

A range of on-chain indicators support our forecast for modest withdrawal pressure:

- 14-day moving average of new validators continues to tick up after the lows post-Terra / 3AC collapse.

- LST tokens of major staking pools trade at a negligible discount, with non-custodial liquid staking providers having the smallest discount (or, in Rocket Pool’s case, even a premium). This supports our view that staked ETH will shift from custodial to non-custodial liquid staking.

- ~39% of stakers are profitable in USD since they began staking. A larger percentage of stakers in profit would suggest higher withdrawal pressure.

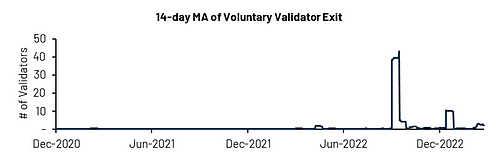

- Low level of voluntary exits by validators in anticipation of the upcoming upgrade. If validators expect a clogged exit queue post-upgrade, some may attempt to front-run the queue by exiting earlier. However, it may still be early, and this is a key indicator to continue to monitor.

Summing It Up

~39k ETH will also become liquid from the 1,136 validators who have exited from the Beacon Chain.

In total, our base case forecast is ~1.8M of ETH that becomes liquid from withdrawals, after adjusting for re-staked ETH. This reflects 1.5% of total ETH supply and 10.5% of total ETH on the Beacon Chain. We believe this projection to be conservative; there is a good chance that the actual figure will be lower than this amount.

We don’t expect all this ETH will be sold. Data indicates that Ethereum’s total supply increasingly stays on-chain instead of being sent to centralized exchanges. We think this trend will persist and expect a considerable amount of ETH unlocked from Shapella will remain on-chain.

Modeling the potential sell flow post-Shapella is out of scope of this report — we leave that up to interested readers to build their own model. However note that, due to the Beacon Chain’s exit queue, any potential sell-flow from full withdrawals will likely be prolonged over weeks instead of occurring over a few days.

The Other Side of the Equation

With the uncertainty overhang of withdrawals finally removed, we foresee an influx of net new demand for staked ETH. Staking ETH will gradually be seen as the de facto benchmark rate within the Ethereum ecosystem, comparable to the Fed Funds rate in the US economy. All-in staking yields should at least match those seen on blue-chip DeFi protocols, such as Aave, Compound, and Euler.

Longer-term, we see 40%+ of ETH will be staked. At 40% staking participation, assuming MEV and priority fees remain at the 30-day trailing average, the all-in APR for validators is ~2.95%.

Impact on Liquid Staking Providers

Shapella benefits liquid staking providers in multiple ways. As mentioned above, LSTs are arguably better collateral compared to ETH. For example, it is capital inefficient to borrow stablecoins against ETH if the same can be done against stETH. And because withdrawals strengthen LSTs’ peg to ETH, their attractiveness as collateral improves. Hence, we expect liquid staking providers to gain market share.

Relatedly, these projects will see lower expenses in maintaining the peg between their LST and ETH. Instant on-chain liquidity for LSTs matters less after Shapella. For instance, consider a scenario where Lido halves its emissions to incentivize liquidity on decentralized exchanges like Curve. Even if the Total Value Locked drastically shrinks, stETH would still hold a tight peg to ETH. This is because if stETH ever trades meaningfully below peg, third-party arbitrageurs would begin to step in. Withdrawals only take ~4–5 days to fulfill in most cases, so we think arbitrageurs would step in even after a 10–30 bps deviation from peg. (At 30 bps, arbitrageurs stand to gain 25% APY from performing the arb). Therefore, DeFi projects like Aave and Compound can still confidently use stETH as a collateral asset, knowing that liquidators and arbitrageurs stand ready to buy any de-pegs.

The upshot is that liquid staking pools will likely see both increased revenues from greater adoption of LSTs along with reduced expenses from token emissions.

A counterargument is that these LST protocols will still need to incentivize liquidity to be well-integrated across DeFi and allow for things like instant liquidations for borrow/lending protocols. But precedents like Euler’s integration of cbETH as collateral suggest that teams understand that instant on-chain liquidity does not fully reflect a token’s collateral quality.

We believe the key beneficiaries will be Lido Finance. Because stETH is widely adopted across different DeFi applications, it offers the greatest utility among LSTs. And Lido’s managed validator set allows it to accommodate a large influx of staking demand (it recently registered over 150k ETH of inflow in one day). Frax Finance and Coinbase should also benefit for similar reasons, although their LST is less widely adopted. Coinbase also offers a higher take rate at 25%.

Rocket Pool likely benefits to a lesser extent. We are fans of its decentralized design and ethos, but it faces scalability challenges due to ETH/RPL collateral requirements. Its higher take rate, designed to draw in node operators, is also a headwind for growth. That said, watch out for its Atlas upgrade as a significant catalyst. Atlas allows node operators to halve their collateral requirement from 16 ETH to 8 ETH, which has the effect of tripling each operator’s capacity — 16 ETH staked in one validator can now be spread across two validators, so capacity for other users increase from 16 ETH to 48 ETH.

Exploring Second-Order Effects

Shapella not only impacts ETH and staking providers. It also creates follow-on impacts on a wide range of verticals, such as:

ETH-backed stablecoins. Two notable ETH-backed stablecoins, Liquity (LUSD) and Reflexer (RAI), face headwinds post-Shapella. As staked ETH de-risks, users may feel more comfortable using liquid-staked ETH as collateral instead of ETH itself. And because Liquity and Reflexer are specifically set up to be minimally governed, they cannot switch their collateral base to liquid-staked ETH. Perhaps that’s a good thing. LSTs still have risks. But these stablecoins already have minimal circulating supply (LUSD: $230M, RAI: $7M), and it is probable that they see lower market share post-Shapella.

Curve/Convex and other DEX’s. Lido has spent nearly 86M of its own governance token (~$230M at today’s price) to incentivize liquidity across decentralized exchanges, mostly to Curve Finance. This is primarily to make stETH a more attractive asset by creating deeper liquidity and allowing low slippage in trading between the two assets. LDO emissions usually make up at least half of the APR from providing liquidity to the stETH/ETH pair. If Lido reduces these rewards, we would see lower stETH/ETH TVL on Curve and other DEX’s, perhaps causing a re-rating in their valuation. For context, the stETH/ETH pair on Curve makes up ~32% of total TVL.

Meta-governance projects like Convex and Aura, which aggregate voting power and receive rewards from projects like Lido, would also see lower rewards under this scenario.

On the other hand, Shapella may also catalyze a wave of new liquid staking tokens. Frax Finance only launched its LST a few months ago and used its control of CVX/CRV to whip up market share. Yearn Finance’s upcoming basket of LSTs will follow a similar playbook to bootstrap liquidity. We may see a burgeoning LST war after the Shapella upgrade.

Leverage staking. Because the peg between an LST and ETH is easier to maintain, users will likely feel more confident to leverage stake ETH through on-chain borrow/lending protocols. Primitives like Aave v3’s e-Mode, which allow users to borrow ETH against staked ETH at a 90% LTV, and Gearbox, which allow up to 10x leverage on stETH, create interesting playgrounds for users to experiment (& get rekt) with leveraged staking. So even if no net new users look to stake ETH, existing users will likely push the limits and drive new ETH on the Beacon Chain.

Re-staking as a primitive. Although EigenLayer’s whitepaper only came out this month, its idea of re-hypothecating staked ETH as a primitive to bootstrap new networks has created excitement through the Ethereum community. The idea is not necessarily new. Both Avalanche and Cosmos have variants of the same concept. But it would further reinforce staked ETH as a desired collateral. Furthermore, if staked participation does indeed reach 40%+, base yields would compress to 3% or lower. In such a scenario, a platform that provides options for greater yield on the same asset would be highly desirable.

Ether’s supply elasticity. Supply elasticity impacts Ether as an asset class to investors and traders. Lower elasticity typically heightens volatility. An open question is whether Ether becomes more or less supply elastic after Shapella. On the one hand, allowing over 16M of ETH to become liquid drastically increases supply elasticity. On the other, this risk is mitigated by the exit queue and Ethereum’s relatively low staking participation. Higher rates of staked ETH could increase short-term elasticity, potentially increasing the asset class’ volatility.

Conclusion

We don’t buy the FUD. Although anything can happen in the short term, the Shapella upgrade is a fundamentally positive event. Amongst other things, it catalyzes higher staking participation, bolsters staked ETH as a desirable asset, improves Ethereum’s security, and de-risks Ether as an asset.

When call we call Ethereum done, if we have to call it done? End of 2023. Merge done. Withdrawals done. Being able to withdraw from the proof of stake system. Basic scaling done. A lot of basic improvements done. Enough cryptography added to Ethereum so that we can support privacy solutions as a layer on top. If we need to, we can stop there. — Vitalik Buterin on the Network State Podcast (emphasis added)

Above all, Shapella will finally put Ethereum’s transition to proof of stake at a close. Developers will finally be able to fully focus on other pressing agendas on Ethereum’s roadmap. After Shapella, look out for EIP-4844, which sets the path for scaling Ethereum by reducing the cost of Layer 2 rollups via danksharding.

Resources

- ETH Withdrawal FAQ

- Beaconcha.in — Beacon Chain explorer and statistics

- Beaconscan — Etherscan’s Beacon Chain block explorer

- Rated Network — Ratings and metrics on Ethereum validators

- Lido on Ethereum Valiator & Node Metrics

- Staking Calculator — BeaconChain

- Simplestakers.info

- Lido Dashboard Catalog (Dune)

- Hildobby’s Ethereum Staking Dashboard (Dune)

Appendix: Lido Finance’s Withdrawal Design

Lido’s design for managing withdrawals from the Beacon Chain clarifies the overall structure for most LSTs. stETH holders go through a three-step process to withdraw:

- Request: To withdraw stETH, users can send a withdrawal request to Lido, locking the amount of stETH to be withdrawn.

- Fulfillment: Afterwards, users enter a queue and the Lido protocol handles requests on a first-in-first-out basis. If there is ETH in a buffer from new deposits or partial skimming, it can be used to fulfill withdrawals. If there is not enough ETH in the buffer, Lido would request the necessary number of validators to exit. Note that this queue is within the Lido protocol and separate from Ethereum’s withdrawal queue.

- Claim: Users claim their share of ETH.

An interesting design choice is that withdrawal requests cannot be canceled but are transferable. It would be possible for a secondary market to form where users in the front of the Lido withdrawal queue can sell their position to those that require liquidity more urgently.

Lido will operate in two modes for withdrawals. In normal times, Lido’s withdrawal will be in turbo mode. Users can typically convert stETH to ETH in ~3–4 days, although this could shrink to just 1–24 hours if there is enough ETH left in a buffer.

However, in the case of mass slashing, Lido will enter bunker mode. This would occur when over 600 Lido validators simultaneously get slashed. No Lido validator has ever been slashed so far. In this mode, all withdrawals will be delayed until losses are socialized between all users. This is to prevent sophisticated users from gaining an advantage over other users, as slashing and penalties occur asynchronously. Without bunker mode, sophisticated actors could predict a mass slashing, withdraw from stETH to ETH to avoid the losses incurred, then re-enter into stETH afterwards.

Lido’s architecture prioritizes stakers by stating the principle of APR maximization. Instead of leaving more ETH in the buffer to facilitate speedier withdrawals, Lido will instead ensure that ETH spends as little time as possible in the buffer.

This dynamic “sinks” ETH supply from Shapella back onto the Beacon Chain. It also compels competitors to do the same, lest they offer lower APRs and give up market share.

Author

Steven Shi is an Investment Partner for Amber Group’s Eco Fund, the company’s early-stage crypto venture fund. He has over five years of experience in hedge funds, private equity, and investment banking firms.

Disclaimer

The information contained in this post (the “Information”) has been prepared solely for informational purposes, is in summary form, and does not purport to be complete. The Information is not, and is not intended to be, an offer to sell, or a solicitation of an offer to purchase, any securities. The Information does not provide and should not be treated as giving investment advice. The Information does not take into account specific investment objectives, financial situation or the particular needs of any prospective investor. No representation or warranty is made, expressed or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of the Information. We do not undertake to update the Information. It should not be regarded by prospective investors as a substitute for the exercise of their own judgment or research. Prospective investors should consult with their own legal, regulatory, tax, business, investment, financial and accounting advisers to the extent that they deem it necessary, and make any investment decisions based upon their own judgment and advice from such advisers as they deem necessary and not upon any view expressed herein.